I didn’t intend to maintain such a long break between posts,

but the cold weather here in North America caused a few unexpected problems.

Meanwhile, the world seems to have decided to go into panic

mode, triggered by a fall in the Argentine Peso.

Obviously the situation really has nothing to do with

Argentina and its currency mismanagement. Devaluations in Argentina are a bit

like eruptions of “Old Faithful” in Yellowstone National Park; if you missed

the last one; it’s never too long to wait for the next one.

In

Davos this week, David Rubenstein (Carlyle Group) and Larry Fink (Blackrock)

both made comments about people being too optimistic and not worried enough. I

have no doubt they were including Emerging Markets in that, but EM problems

have been very widely flagged since last summer, whilst the S&P has gone on

to reach new highs.

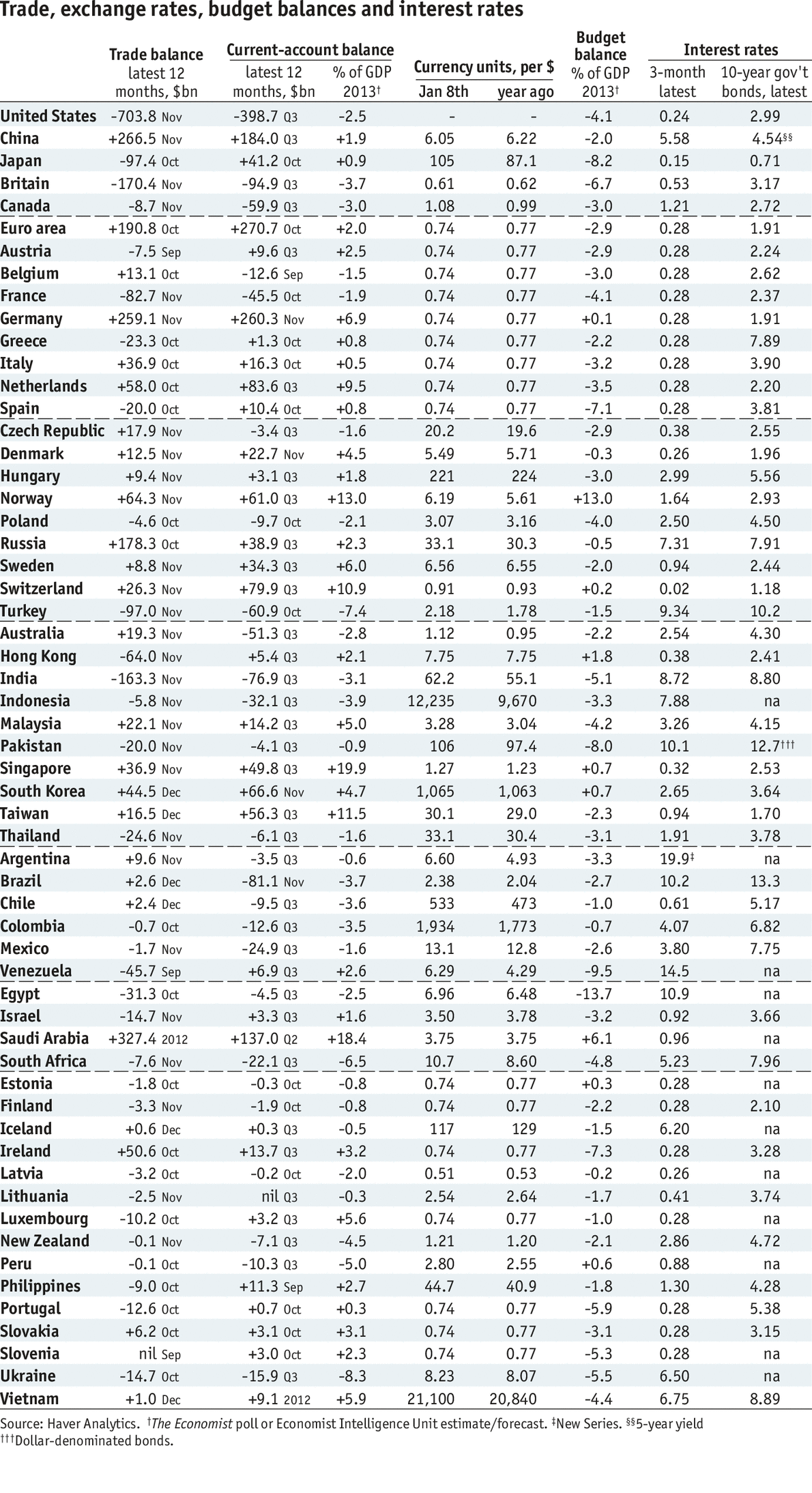

From

the attached Economist data table, one can see that the “Fragile Five” do

indeed have week external balances. Looking at

Brazil, we see a Current Account deficit of 3.7% of GDP and a Budget deficit of

2.7%, almost as bad as the UK’s numbers (3.7 and 6.7), and only slightly worse

than Canada’s (3.0% and 3.0%). Most of the famous “PIIGS” have at least one measure

significantly worse than the “Fragile Five”, whilst PIIGS Gross Public Debt

numbers are all worse than those for the Fragile Five.

I have

also attached the Economist‘s Sinodependency index, an attempt to show how

dependent large US companies are on China. It would be interesting to see the

concept expanded to Emerging Markets in general, and across countries other than the US;

Germany’s Volkswagen is the number 1 brand in China currently. The original interactive version is available here.

I am

not trying to divert attention away from the significant problems that exist in

Emerging Markets; they would not be Emerging Markets if they didn’t have

problems. One of the lessons, however, that should have been learned from the

Global Financial Crisis was that the differences in risks between Developed

Markets and Emerging are less than popularly perceived, not because Emerging

risks are lower, but because Developed risks are higher, even if only because

of their increased Emerging Markets exposure.

I still

remain deeply skeptical of the Euro project; despite all the talk of the

various PIIGS being saved, they are still massively in debt, with at least one

of their major balances – usually the Budget deficit – still very ugly. The

overall Euro area may be in balance but that still cleaves between an almost

predatory Northern group, and the moribund Southern group; the

“failure-to-launch” of the French Economy puts them firmly in the Southern

group. Comments out of the UK about France being the real weak link in the Euro are probably more about British Schadenfreude for all things French, but they do serve to highlight the extent of France's problems.

The

Basel III leverage requirements were recently watered down at the insistence of

the German and the French Governments because it would have forced their banks

to shrink their balance sheets more aggressively than is currently happening;

in short, their banks still require massive regulatory forbearance because they

have not been cleaned up to the extent of the US and UK banks.

The UK is expected to be the fastest growing major economies

in 2014, and should be the first to raise interest rates, but that has come at

the expense of a re-inflated housing bubble. It’s only a matter of time before

UK TV is again dominated by shows telling everyone how easy it is to make money

by flipping properties.

Shadow banking, not just in China, is going to be a major

issue this year. As the

FT recently reported, “Shadow banking worries

extend far beyond China. Paul Tucker, a former Bank of England deputy governor,

claimed on Thursday that regulators around the world were struggling to keep up

with the pace of change in the “shape-shifting” non-bank sector. He warned of

“faltering vigour” in official oversight of global markets.

In a paper published by the

US think-tank, Brookings Institution, Mr Tucker said regulators around the

world needed to display greater flexibility to cope with “endemic regulatory

arbitrage and the shape-shifting dynamic of finance”, pointing to problems in

both advanced and emerging market economies.’

So I have to agree with Messrs. Rubenstein and Fink, there

is a lot to be worried about, but where can we look for relief?

I actually take comfort from the reduction of QE by the Fed.

US house prices have clearly bottomed, and as I mentioned in a previous post,

US economic growth is gaining traction. Even if that does not justify the

current valuations of the S&P, a stronger US economy can only be a good

thing.

Despite my fears of a UK housing bubble, their economy unquestionably

has momentum, and, having used unemployment as an early indicator to raise

rates, failing to follow through would undermine BoE credibility. I think even

a symbolic increase of 1/8th accompanied by the message that the

Bank was actively monitoring the effects of the increase on the economy, which

they would be doing anyway, would send a very positive message.

The fact the Brazil’s President, Dilma Rousseff, went to

Davos on a charm offensive, rather than trying to polish her socialist

credentials as in previous years, suggests she at least recognizes the

magnitude of her problems. A swift readjustment to imported diesel prices to

compensate for the weaker exchange rate would also suggest she is prepared to

act. Unfortunately, the World Cup followed by Presidential elections in October

mean we are unlikely to see anything more decisive than that. IF, however, she

replaces Guido Mantega as Finance Minister in her second term that would really

set the markets racing.

Chinese New Year is early this year, starting January 31st.

Given that it is always a confusing period for Western observers that is

probably a good thing. We have already seen signs of seasonal disruption to

Steel inventories, Iron ore shipments, and possibly even the PMI. Currently the

prevailing attitude seems to be all news is bad news, so the sooner we can get

past these distortions, the better we can understand the real situation,

whatever that might be.

Turkey will get a pass. Unless PM Erdogan does something

really stupid, he will ultimately enjoy the backing of the US, the EU, and the

IMF, despite all the sturm and drange

in the meantime. Turkey is too important an ally, and despite Erdogan’s

increasingly authoritarian tendencies, the country is firmly on the democratic

track. Even 10 years ago the army would have been on the streets by now. I have

known Mehmet Simsek, Turkey’s Minister of Finance, for years and he is a VERY

safe pair of hands.

Elsewhere, the $7 billion in investments that Enrique Peña

Nieto of Mexico managed to secure at Davos shows the benefits of his reform

program. I am under no illusions as to the enormity of the task ahead of him in

actually implement his program, but he has already made more progress than

either Presidents Fox or Calderon, and he seems to be able to forge alliances

with the other parties to produce some kind of result.

Sub-Saharan Africa has seen a renaissance in recent years.

The commodities boom may have triggered it but it has gained a momentum of its

own as local firms, such as Dangote in Nigeria, as well multinationals such as

Nestlé and South Africa’s Tiger Brands look to expand. Some of the initiatives,

like Kenya’s Mpesa, are truly world class and will continue to drive growth

forwards.

Currently I am working on the premise that the first half of 2014 is going to be highly volatile, with at least a major correction across all markets, but I see that correction as being highly cathartic. The kind of correction that would give Merrill's Michael Hartnett his major buy signal, so I am also putting in place my strategies for that spike down.